-

![instabill]() Instabill - GST Invoice, Payment & Inventory Software

Download for FREE |

Instabill - GST Invoice, Payment & Inventory Software

Download for FREE |

- Offers

|

| - Learning Resources |

- LOGIN/SIGN UP |

- 8881069069

|

| Our professionals can assist you obtaining ESI registration as well in regular ESI compliances while you stay relaxed and concentrate on the primary roles of the business.

Providing business banking solutions in association with ICICI Bank

Facilitating Neo Banking Solutions & Corporate Credit Card to Startups

Trusted by Axis bank to cater its clients all licensing & compliance needs

Providing lending solutions for business needs with NeoGrowth

ESI is an autonomous organization under the Ministry of Labour and Employment, Government of India. Employee's State Insurance (ESI) is a self-financing social security and health insurance scheme for Indian workers. .

The scheme provides full medical cover to the employee registered under the ESI Act, 1948 during the period of his incapacity, restoration of his health and working capacity.

It provides financial assistance to compensate for the loss of his/ her wages during the period of his absenteeism due to sickness, maternity and employment injury. This scheme provides medical claim to his/her family members also.

ESI Registration is mandatory for every factory and specified establishments who have 10 or more permanent employees and wages of such employees are less than Rs. 21,000/- per month.

Yes, it is the statutory responsibility of the employer under Section 2A of the Act read with Regulation 10-B, to register their Factory/ Establishment under the ESI Act within 15 days from the date of its applicability to them.

According to the notification issued by the appropriate Government (Central/State) under Section 1(5) of the Act, the following establishments employing 10 or more persons attract ESI registration coverage

In case of any non-compliance by an employer, such as failure to get esic employer registration online or not fulfilling esi return filing procedure, he shall be liable for a fine of INR 10,000/-.

ESI Registration provides monetary and medical benefits to employees in case of sickness, maternity and employment injury and to make provisions for related matters.

Some of the benefits of ESI Registration are :

Every month, employers are required to contribute 3.25 % and employee contributes 0.75% of the wages payable. Total ESI contribution i.e. 4% deposited to the ESIC fund.

Total ESI contribution is 4%

ESI contribution rates for employee and employers are as below :

|

Employee |

Employers |

|

3.25% |

0.75% |

Â

All the business entities having an ESIC Registration need to do regular ESI return filing.

The following below are ESI returns as follows:

|

ESI Returns |

Interval |

Due Date |

|

Form 5 |

Half Yearly |

April to September: 11th November October to March: 11th May |

|

Form 1a |

Annually |

31st January |

Â

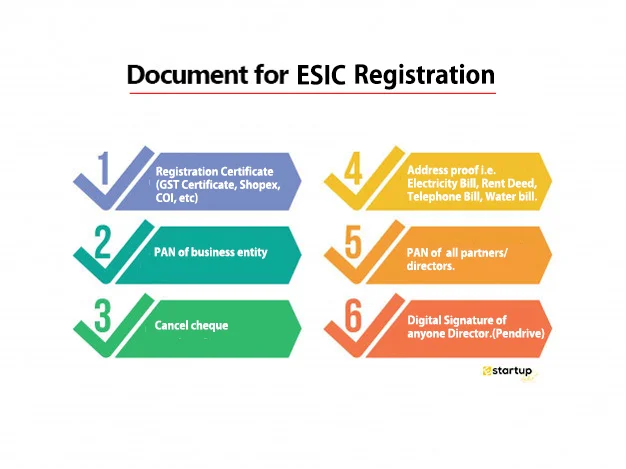

Upload the Necessary Documents on our web portal.

Choose the appropriate Package and Pay online with various payments modes available.

On placing the order, your application will be assigned to one of our dedicated professionals.

Our professional will fill up the required ESI registration form for the employee.

Upon verification, the ESI registration form will be submitted.

After ESI account is created, the ESI registration certificate will be sent to the applicant.

Serving business owners with an Average 4.8+ Google Rating.

Trusted by Axis bank to cater its clients all licensing & compliance needs.

Providing lending solutions for business needs with NeoGrowth.

Providing business banking solutions in association with ICICI Bank.

E-startupindia is a Proudly Member of Confederation of Indian Industry.The CII is a premier business association in India which works to create an environment.

E-Startup India is duly certified under GOI's Startup India scheme and is renowned for our tech-driven solutions for business & legal services requirements for MSMEs.

E-Startup India is a Google Partner, which implies we are rigorously involved in assisting SME businesses to market their presence in the digital world.

Instabill - GST Invoice, Payment & Inventory Software

Download for FREE |

Instabill - GST Invoice, Payment & Inventory Software

Download for FREE |